Reforming Military and Uniformed Personnel Pension System Crucial to Maintaining Investment Grade Rating in Philippines

Key Highlights :

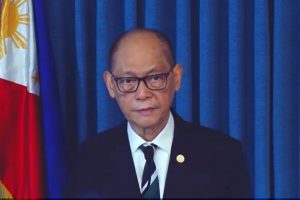

The Philippines risks losing its investment grade rating if it fails to reform an “unsustainable” military and uniformed personnel (MUP) pension system, Finance Secretary Benjamin Diokno warned senators during a budget hearing on Wednesday. The Philippines has held an investment-grade rating for the past decade, but if the government continues to ignore the need for reform, it could be relegated to “junk” territory.

Currently, the pension system for troops and uniformed personnel, including police and prison staff, is funded solely by the government budget. These personnel are not required to contribute to their pensions, and the government has forecast that the amount needed to pay for MUP pensions will increase to 537 billion pesos by 2030 and to 1.5 trillion pesos by 2040.

Diokno has been pushing for changes, including making contributions mandatory, in order to speed up fiscal consolidation and free up resources to fund much-needed infrastructure. The aim is to reduce the government deficit to 3.0 % of gross domestic product (GDP) and debt to 51.1% of GDP by 2028, from 6.1% and 61% this year, respectively.

“The pension system is not a real pension system in the following sense – there are no contributors. A pension system is where the beneficiaries of the pension system contribute and there’s a government counterpart,” Diokno said.

Reforming the MUP pension system requires legislation, and Diokno stressed that the current set up was “unsustainable” because it would become a “huge component of the national budget”. He added that if the government fails to reform the system, it will constrain its ability to cut its debt and deficit, which could result in the country losing its investment grade rating.

The Philippines has seen a number of positive economic developments in recent years, including strong growth, improving debt dynamics, and better fiscal policies. However, the country’s fiscal health is still fragile and the government must take steps to ensure it can maintain its investment grade rating. Reforming the MUP pension system is an essential part of this process, and the government must act quickly to ensure it can continue to benefit from the international investment it has attracted in recent years.