Market Trends: After a Big Dip - A Historical Perspective

Understanding the Recent Market Trends

After two consecutive days of market declines, seasoned investors recognize this as a typical phase in the economic landscape. Historically, markets are cyclical, and significant drops can sometimes signal an upcoming recovery period. But what factors contribute to the market's behavior, and what should investors be aware of?

The Trump Tariffs' Ripple Effect

The imposition of tariffs by the Trump administration has had far-reaching effects on global trade dynamics. This move, aimed at protecting national interests, inadvertently disrupts supply chains and affects market stability. Investors need to stay informed on policy changes by following platforms like Amazon for insightful resources on economic policies.

"The stock market is filled with individuals who know the price of everything, but the value of nothing." - Philip Fisher

Understanding market value versus price is crucial, especially in volatile times. Philip Fisher's insights remind us that long-term strategies often yield the best results compared to short-term reactions driven by panic or fear.

Historical Patterns and Market Rebounds

Market history suggests that after significant downturns, there is often a rebound. Factors such as government interventions, adjustments in economic policies, and natural market correction contribute to this phenomenon. A study from JSTOR elucidates these patterns and how investors can prepare for future market rebounds.

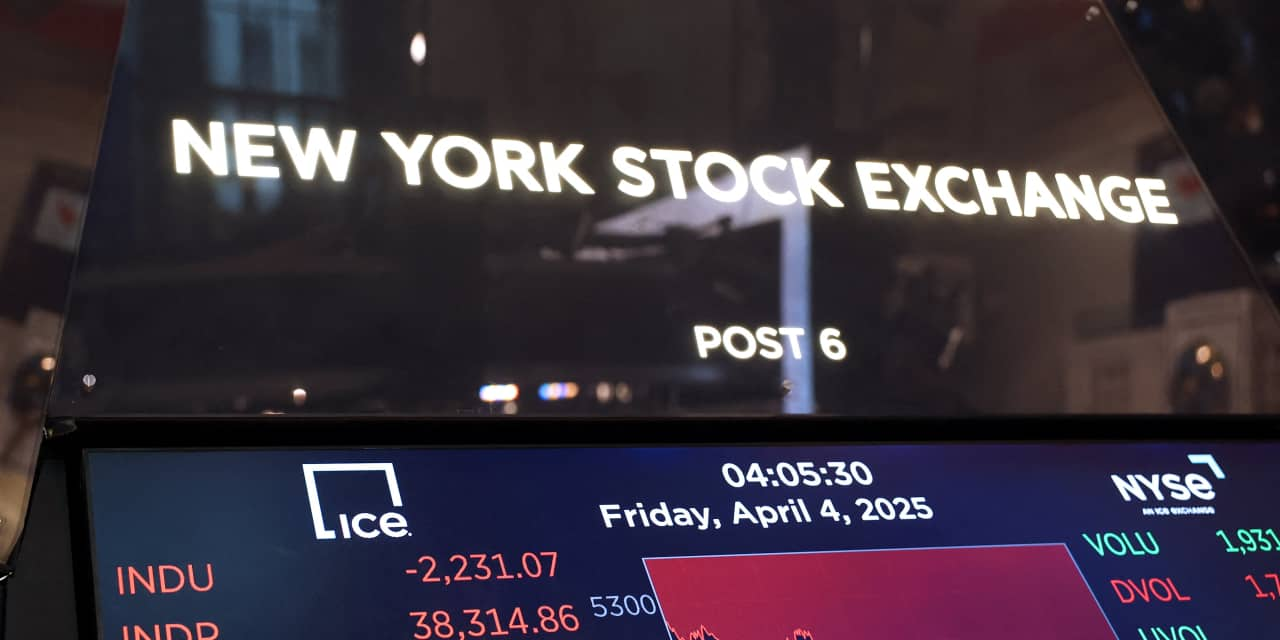

Visual representation of ongoing market trends can offer better insight into market analysis.

Investor Strategies During Market Volatility

- Diversify your investment portfolio to mitigate risks.

- Stay informed on global economic news to anticipate market shifts.

- Consider long-term investments over short-term gains.

Leveraging Expert Opinions

Financial experts often offer insights that can guide investment decisions. Following professionals such as Jim Cramer of CNBC on Twitter can provide valuable, real-time opinions on market trends and forecasts.

Conclusion - Staying Ahead in Uncertain Times

While certainty in stock markets is a rare commodity, understanding historical patterns and global events can give investors an edge. Continuous learning from reliable sources, alongside strategic planning, ensures better preparedness for future market movements.